delayed draw term loan commitment fee

The fee amount accumulates on the portion of the undrawn loan until the loan is either fully used terminated by the borrower or. Draw term loans are structured with a maximum loan amount that can be accessed throughout a certain time frame called a draw period.

A delayed draw term loan also referred to as DDTL is a particular feature of a term loan where the lender disburses pre-approved loan amount based on a pre-determined time schedule.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

. DDTLs provide enhanced flexibility for longer-term capital. Like revolvers they have commitment fees around 1 and in addition they carry ticking fees which charge the borrower additional points the longer the commitment is outstanding and unused. Sponsors Holster Revolvers For Delayed Draw Loans Churchill Asset Management Financing Fees Deferred Capitalized Amortized New Libor Floor Provisions Market Trends 2020 2021 Financing Fees Deferred Capitalized Amortized Take Out Loan Definition What Is A Delayed Draw Term Loan Ddtl 2.

Tranche C Loanmeans an extension of credit by a Lender to TFA under Article II including a Loan converted to a term Loan pursuant to Section 213c. While the fee structure for DDTLs has always been a negotiated point and has varied based on the actual arrangements sponsorsborrowers and debt providers the migration of the DDTL tranche upmarket has put the spotlight on some of those economics. Term Loan Commitment Percentage.

TAxATION OF DELAYED DrAW TErM LOANS loan market might feature a term loan of 400 million that matures seven years from the closing date a revolving facility of 60 million available for a commitment period of five years from the closing date and a 100 million DDTL facility available to draw for two years from the closing date. In the case of a one-time loan the commitment fee is negotiated between the lender and the borrower. A fee paid by a borrower on the unused portion of its revolving credit loans or delayed-draw term loans to compensate the lenders for their commitment to make the funds available to the borrower for a certain period of time.

Withdrawal periods could be every few months or every year. Delayed draw term loans may come in terms of say three or five years with interest-only periods such as six months to one year. Means on any date with respect to the Initial Delayed Draw Term Loan Commitments 100 per annum.

Delayed Draw Term Loan Commitment. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. Delayed draw term loans include a ticking fee a fee paid from the borrower to the lender.

Has the meaning assigned to such term in Section 210c. Delayed Draw Term Commitments Commitment Fee. Except as provided in Section 216c Tranche C Loans shall be denominated in Australian Dollars.

The Borrower shall pay to the Administrative Agent for the account of each Delayed Draw Term Lender in accordance with its Pro Rata Share of such unused a. The fee can be a flat amount such as 1000 or a percentage of the loan amount such as 1. The Borrower agrees to pay to the Administrative Agent for the account of each Delayed Draw Term Loan Lender of any Class other than any Defaulting Lender a commitment fee the Delayed Draw Ticking Fee which shall accrue at a rate per annum equal to the Delayed Draw Term Loan Commitment Fee Rate applicable to the Delayed Draw Term Loan Commitments of.

Delayed Draw Term Loanhas the meaning specified in Section 201c. Tranche C Term Loan Commitment. Shall have the meaning set forth in Section 401a.

This pay-for-delay compensation may be important because cash deals are nearly universally struck at a fixed cash price paid at closing whenever that happens. In this case the ticking fee is paid pursuant to a commitment agreement signed by the prospective lender rather than the credit agreement. Delayed draw term loans are usually valued at very large amounts.

Define Unused Delayed Draw Term Loan Commitment Fee. Define Delayed Draw Term Loan Commitment Fee Termination Date. For example they could range from 1 million to over 100 million.

DDTLs carry ticking fees akin to commitment fees which are payable during the commitment period on the unused portion of. How are Delayed Draw Term Loans Structured. Applicable Revolving Commitment Fee Percentage.

A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans already closed. The delayed draw period is an extended draw period usually offered to. For example you can have loan withdrawals taking place every three months or six months or at other intervals agreed by the lending institution.

Although ticking fees are most often reluctantly conceded by buyers a. Define Initial Delayed Draw Term Loan Commitment Fee Rate.

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Does Ifrs 15 Or Ifrs 9 Apply To Fees Charged To Customers By Lenders Bdo Australia

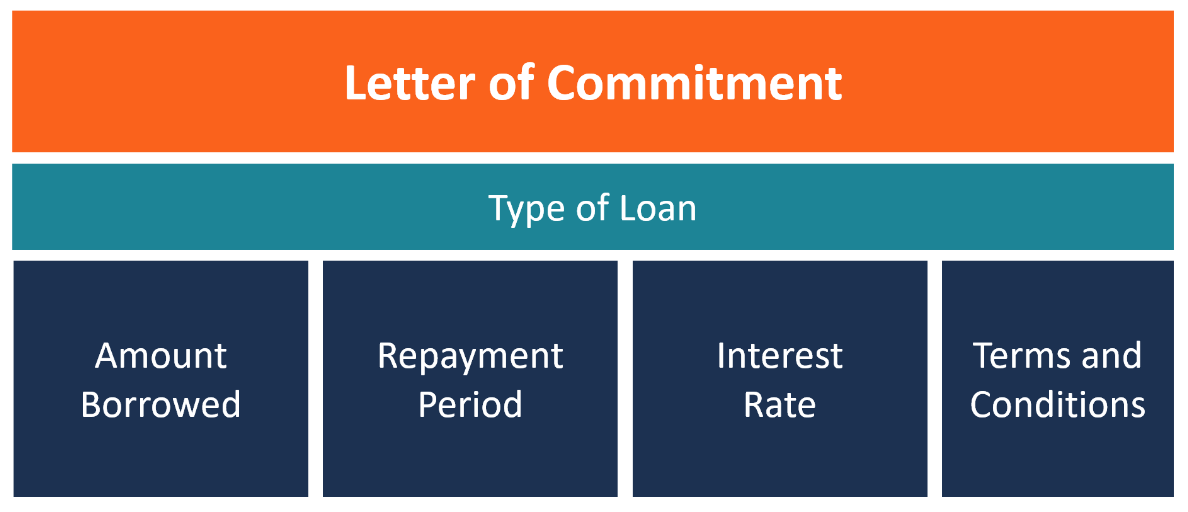

Letter Of Commitment Overview Example And Contents

Financing Fees Deferred Capitalized And Amortized Types

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Financing Fees Deferred Capitalized And Amortized Types

Mortgage Commitment Letters Get Them Signed Before They Expire Reca Reca

How To Calculate An Interest Reserve For A Construction Loan Propertymetrics

Financing Fees Deferred Capitalized And Amortized Types

A First Time Buyers Guide To Understanding The Construction Loan Process Newhomesource Home Improvement Loans Construction Loans Home Construction

Delayed Draw Term Loans Financial Edge

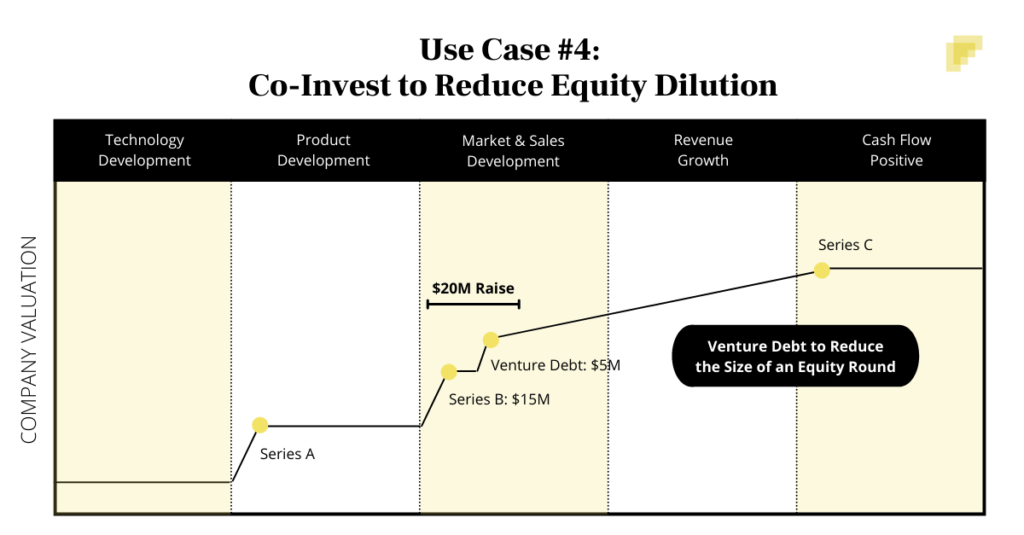

The Founder S Guide To Venture Debt Flow Capital

Sponsors Holster Revolvers For Delayed Draw Loans Churchill Asset Management

Advanced Lbo Test Modeling Test Private Equity Interview Training Excel Template

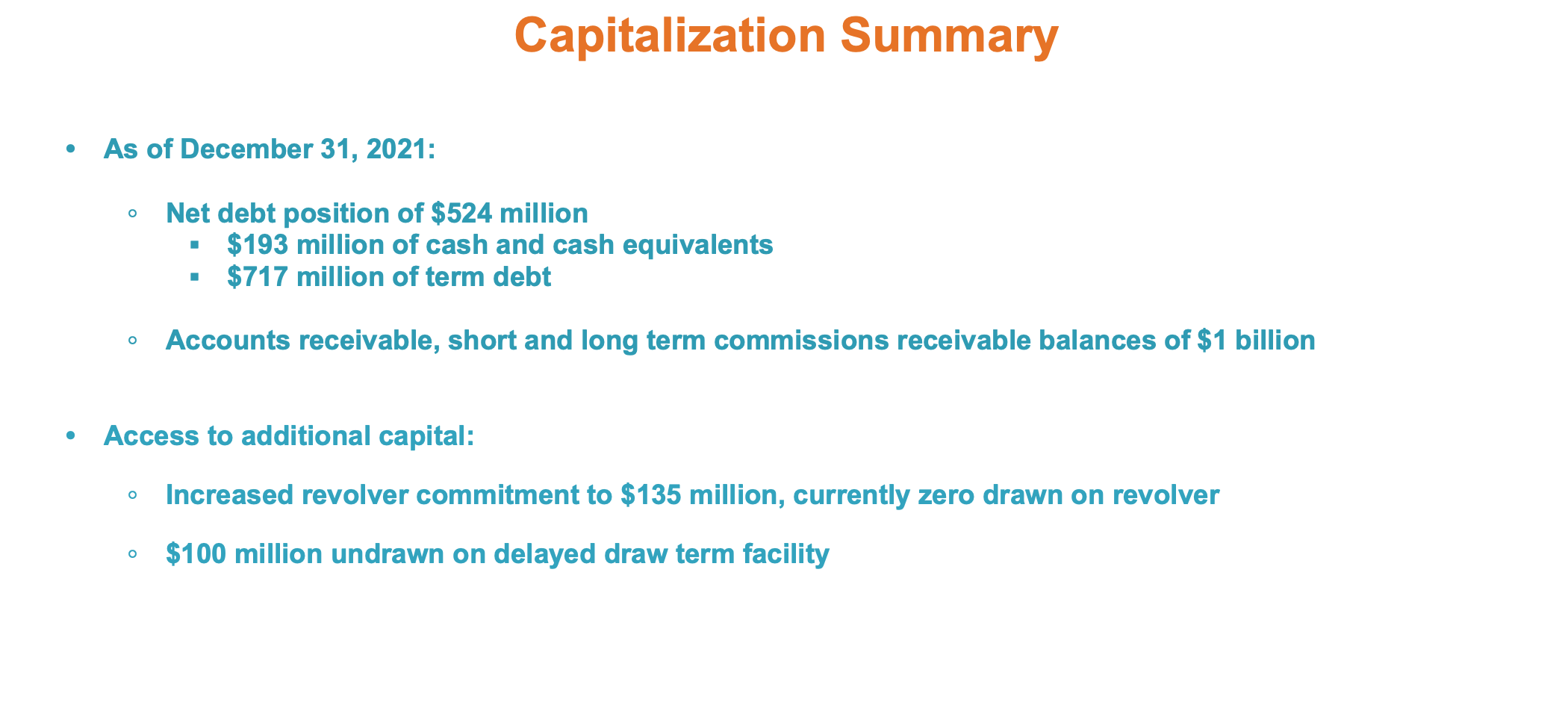

Selectquote Stock This Did Not Turn Out As Planned Nyse Slqt Seeking Alpha